Chipotle’s Business Model and Performance

Chipotle Mexican Grill, Inc. is a popular fast-casual restaurant chain that has carved a niche for itself in the competitive food service industry. The company’s success can be attributed to its unique business model, which emphasizes fresh ingredients, customization, and digital ordering. This strategy has led to impressive financial performance and positioned Chipotle as a leader in the fast-casual restaurant segment.

Chipotle’s Core Business Model

Chipotle’s business model revolves around a few key pillars:

- Fresh Ingredients: Chipotle emphasizes using fresh, high-quality ingredients, including locally sourced produce whenever possible. This commitment to quality is a core part of its brand identity and resonates with health-conscious consumers.

- Customization: Customers have complete control over their meals, choosing from a variety of ingredients and customizing their burritos, bowls, tacos, and salads. This personalized approach caters to diverse dietary preferences and enhances the dining experience.

- Digital Ordering: Chipotle has embraced digital ordering, offering online and mobile ordering options. This has streamlined the ordering process, reduced wait times, and enhanced convenience for customers.

Chipotle’s Recent Financial Performance

Chipotle has consistently delivered strong financial performance in recent years.

- Revenue Growth: The company has experienced consistent revenue growth, driven by new restaurant openings and increased same-store sales. For instance, in 2022, Chipotle’s revenue grew by 13.7% compared to the previous year.

- Profitability: Chipotle has also demonstrated strong profitability, with increasing operating margins. The company’s focus on operational efficiency and pricing power has contributed to its robust bottom line.

- Key Financial Ratios: Several key financial ratios highlight Chipotle’s strong performance. Its return on equity (ROE) consistently exceeds the industry average, indicating efficient use of shareholder capital. Additionally, its debt-to-equity ratio remains low, suggesting a conservative financial strategy.

Chipotle’s Performance Compared to Competitors

Chipotle’s financial performance has outpaced many of its competitors in the fast-casual restaurant industry.

- Comparable Sales Growth: Chipotle’s same-store sales growth has consistently outperformed competitors like Panera Bread and Subway, indicating strong customer loyalty and brand appeal.

- Profitability Metrics: Chipotle’s operating margins are generally higher than those of its peers, demonstrating its ability to manage costs effectively and generate higher profits.

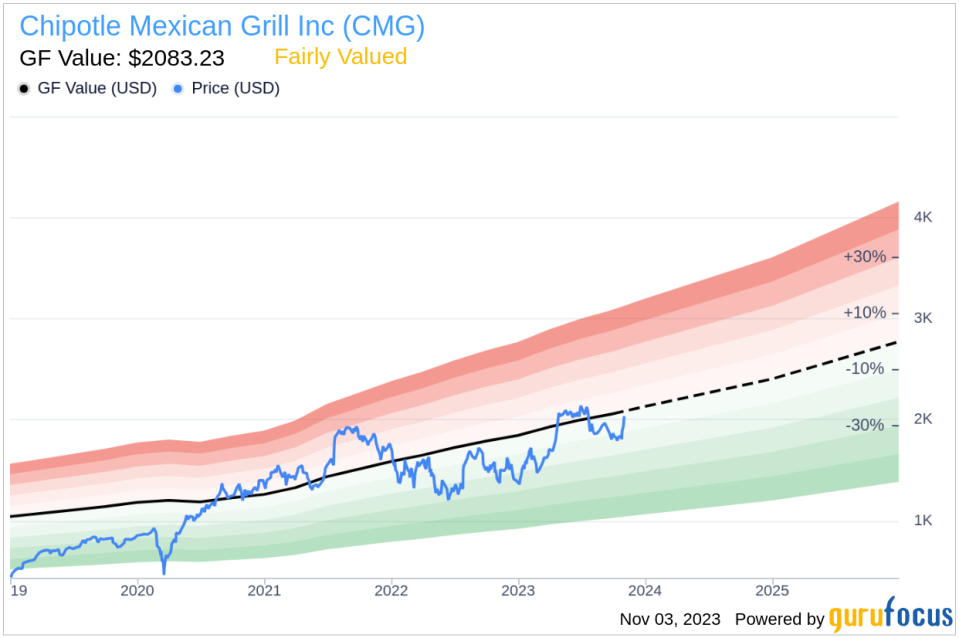

- Valuation: Chipotle’s stock valuation, as measured by its price-to-earnings (P/E) ratio, is often higher than its competitors, reflecting investor confidence in its future growth potential.

Factors Influencing Chipotle Stock Price

Chipotle Mexican Grill’s stock price is influenced by a complex interplay of factors, encompassing its financial performance, industry trends, macroeconomic conditions, and investor sentiment. Understanding these factors is crucial for investors seeking to analyze Chipotle’s stock performance and make informed investment decisions.

Earnings Reports, Chipotle stock

Chipotle’s earnings reports are a primary driver of its stock price. Investors closely scrutinize these reports for insights into the company’s financial health, revenue growth, profitability, and future prospects. Strong earnings reports, characterized by exceeding analysts’ expectations and demonstrating consistent revenue and profit growth, typically lead to positive stock price movements. Conversely, disappointing earnings reports, marked by missed earnings targets or declining profitability, often result in downward pressure on the stock price.

Industry Trends

The fast-casual restaurant industry, in which Chipotle operates, is subject to various trends that influence its stock price. Consumer preferences for healthy and convenient dining options, the rise of delivery and online ordering, and competition from other fast-casual chains all play a role. For instance, increased consumer demand for plant-based options has driven Chipotle to expand its menu offerings, potentially impacting its stock performance.

Macroeconomic Conditions

Chipotle’s stock price is also influenced by broader macroeconomic conditions. Economic growth, inflation, interest rates, and consumer confidence can significantly impact the company’s performance. During periods of economic expansion, consumers tend to have more disposable income, potentially leading to increased spending at restaurants like Chipotle. Conversely, economic downturns can lead to reduced consumer spending and lower demand for fast-casual dining, affecting Chipotle’s stock price.

COVID-19 Pandemic

The COVID-19 pandemic significantly impacted Chipotle’s stock performance. Early in the pandemic, the company faced challenges due to lockdowns and social distancing measures, resulting in reduced dine-in traffic. However, Chipotle adapted by prioritizing digital ordering and delivery options, which helped mitigate the negative impact. As the pandemic progressed and restrictions eased, Chipotle experienced a rebound in sales and its stock price recovered.

Investor Sentiment and Analyst Ratings

Investor sentiment and analyst ratings play a crucial role in shaping Chipotle’s stock price. Positive investor sentiment, driven by factors like strong earnings reports, innovative product launches, or positive industry trends, can lead to increased demand for Chipotle’s stock, driving its price upward. Conversely, negative investor sentiment, stemming from factors like disappointing earnings, food safety concerns, or negative industry trends, can depress the stock price. Analyst ratings also influence investor sentiment. Positive ratings from prominent analysts can boost investor confidence and drive up the stock price, while negative ratings can have the opposite effect.

Growth Strategies and Future Prospects

/GettyImages-509058622-5734c7ec3df78c6bb0ec1bf2.jpg)

Chipotle’s success hinges on its ability to continue expanding its footprint, innovate its menu, and leverage digital channels to enhance customer experience and drive sales. These growth strategies are essential for Chipotle to maintain its competitive edge in the fast-casual dining market.

Expansion Plans

Chipotle’s expansion plans are a key driver of its growth strategy. The company is actively opening new restaurants in both existing and new markets. This expansion strategy allows Chipotle to reach new customers and increase its revenue. Chipotle is focused on opening restaurants in urban areas, college towns, and suburban locations with high population density and strong demand for fast-casual dining.

Menu Innovation

Chipotle’s menu innovation strategy is designed to attract new customers and retain existing ones. The company periodically introduces new menu items, such as the Carne Asada, and limited-time offerings, such as the Cilantro-Lime Chicken. These new items provide customers with more variety and cater to evolving tastes. Chipotle also regularly updates its menu to include healthier and more sustainable options. For example, the company has introduced vegetarian and vegan options, as well as organic ingredients.

Digital Initiatives

Chipotle has made significant investments in digital initiatives to enhance customer experience and drive sales. The company’s online ordering platform, mobile app, and delivery partnerships allow customers to order food conveniently and quickly. These digital initiatives are also helping Chipotle to collect valuable data on customer preferences and behavior, which it can use to improve its menu and marketing efforts.

Risks and Opportunities

Chipotle faces a number of risks and opportunities in the future.

Competition

The fast-casual dining market is highly competitive. Chipotle faces competition from a wide range of restaurants, including other fast-casual chains, traditional fast-food restaurants, and even fine dining establishments. Chipotle must continue to innovate and differentiate itself to stay ahead of the competition.

Labor Costs

Labor costs are a significant expense for Chipotle. The company is facing pressure from rising minimum wages and a tight labor market. Chipotle is investing in technology to automate some tasks and improve employee efficiency, but it must find ways to manage labor costs effectively to maintain profitability.

Food Safety Concerns

Chipotle has faced a number of food safety concerns in recent years. These concerns have damaged the company’s reputation and led to a decline in sales. Chipotle has implemented new food safety protocols and procedures to prevent future incidents. The company must continue to prioritize food safety to regain customer trust and protect its brand.

Summary of Growth Initiatives

| Growth Initiative | Expected Impact |

|---|---|

| Expansion Plans | Increased revenue, wider customer reach, and enhanced brand visibility |

| Menu Innovation | Attracting new customers, retaining existing ones, and catering to evolving tastes |

| Digital Initiatives | Enhanced customer experience, increased sales, and valuable customer data |